Brijesh Goel and Amit Bhardwaj Face Criminal Charges for Alleged Insider Trading

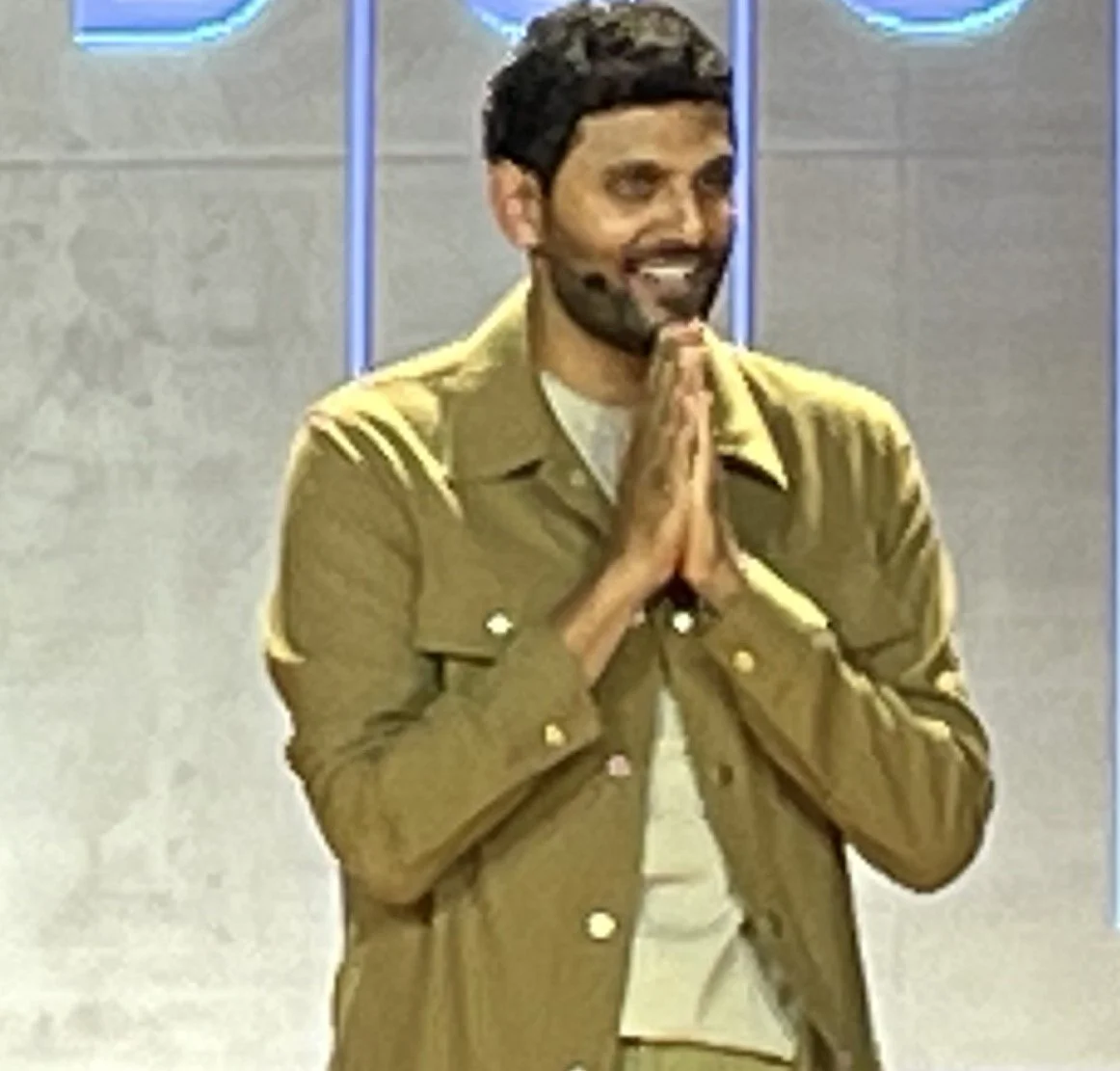

Amit Bhardwaj in a photo about customer stories posted by TrendMicro.

July 26, 2022

This week, criminal and civil cases over alleged insider trading were filed in New York against Amit Bhardwaj, Dhirenkumar Patel, Srinivasa Kakkera, Abbas Saeedi and Ramesh Chitor and separately against Brijesh Goel and Akshay Niranjan. The criminal cases were filed by the U.S. Department of Justice (DOJ) and civil cases by the Securities and Exchange Commission (SEC).

Gurbir S. Grewal, Director of the SEC's Enforcement Division and an Indian American, said in a statement that "today's actions show, we stand ready to leverage all of our expertise and tools to root out misconduct and to hold bad actors accountable no matter the industry or profession. That's what’s required to restore investor trust and confidence."

Amit Bhardwaj was former Chief Information Security Officer (“CISO”) of Lumentum Holdings, a San Jose, California based optics and photonics company with a market value of about $6 billion. During 2020 and 2021, while CISO, Bhardwaj allegedly traded on “material, non-public information…and tipped his criminal associates” about two potential acquisitions by Lumentum, the DOJ said in a statement. As a result, Bhardwaj and his friends Dhirenkumar Patel, Srinivasa Kakkera, Abbas Saeedi and Ramesh Chitor, all residents of Silicon Valley, made $5.2 million in alleged illicit profits.

The DOJ further alleges that Bhardwaj, 49 years old, Kakkera, 47, and Saeedi, 47, “took steps to obstruct the federal investigation of their conduct.” In March this year, while being interviewed by the Federal Bureau of Investigation, Bhardwaj “drove to the homes of certain of his co-conspirators to encourage them not to tell the federal authorities the truth about their insider trading scheme.” The three of them and Dhirenkumar Patel, 50, “then met in person on multiple occasions and discussed, among other things, potential false stories that would conceal their insider trading scheme, as well as creating false documents to buttress lies regarding payments that were, in reality, related to the insider trading scheme,” the DOJ said in a statement.

Bhardwaj also sought Patel’s help in “seeking to ensure that any potential incriminating information” from Bhardwaj’s work laptop would be deleted. Patel and Ramesh Chitor, 45, have “pled guilty and are cooperating with the Government,” according to the DOJ. Presumably, as part of their plea deal, Patel and Chitor will face a lighter prison sentence. Bhardwaj, Kakkera and Saeedi, if found guilty, could face up to a maximum 25 years in prison.

Bhardwaj was at Lumentum from 2019 till the 15th of this month. Earlier he was employed in the United Kingdom, including at accounting and advisory firms BDO, KPMG and Ernst & Young and also spent eight years at United Utilities. He worked in Cyber Security and Security and Risk Operations. He holds an MBA from Manchester University, U.K., a Master’s from Bombay University and a Bachelor’s degree from Delhi University, according to zoominfo.

In different lawsuits, also filed this week, the DOJ and the SEC allege insider trading by Brijesh Goel and Akshay Niranjan. In 2017, they allegedly “made more than $275,000 from illegally trading ahead of four acquisition announcements” that Goel learned about through his employment at Goldman Sachs, the investment bank. “Niranjan purchased call options on the target companies and later wired Goel $85,000 for Goel’s share of the proceeds,” according to the SEC’s statement.

Goel, 37, worked in Goldman’s Structured Credit desk in New York from 2013 to 2021, rising to become vice president. He then joined Apollo Global Management, a New York private equity firm. He was "immediately placed on indefinite leave" when the company learned about the allegations this week, an Apollo spokesperson told Reuters.

Prior to Goldman, Goel was an analyst in the Prime Brokerage operations at Deutsche Bank. Earlier in 2012 he worked as an intern at State Street Global Advisers, Boston, and in 2008 was an analyst at HSBC.

Goel holds a Master’s in Financial Engineering from the Haas Business School at the University of California, Berkeley, and a B.Tech in mechanical engineering from the Indian Institute of Technology, Roorkee.

At least up until today, a day after the DOJ and SEC announcements of his alleged crime, Goel - and his profile - was listed as a member of the board of Akanksha, on its website. The New York based non-profit states its mission is to “advance better educational outcomes for underserved children in India, by raising awareness and providing donors in the U.S. with opportunities to make an impact.”

Niranjan, 34, was a foreign exchange trader in New York for Barclays, the British bank. Like Goel, he holds a Master’s in Financial Engineering from the Haas Business School at the University of California, Berkeley, 2013. He earned a B.Tech from the Indian Institute of Technology, Bombay, 2010 and finished high school from the privately run Delhi Public School in R.K. Puram, New Delhi, 2006.

Niranjan and Goel, friends from business school, played squash together. As several media reports have pointed out, both of them earned sizeable salaries and bonuses compared to their gains from the alleged illegal trading.

Goel and Niranjan, as well as Bhardwaj, have apparently erased their profiles on LinkedIn. Except for Patel and Chitor, lawyers for the other five Indians reportedly say their clients are innocent.

A description about Bhardwaj as a speaker for a technology and security conference, held in July 2020, and which was accessible online as of today, states that he advocates “Security is everyone’s responsibility” and appreciates clients keeping their organizations safe.

For access to stories each week, follow on: LINKEDIN or TWITTER or FACEBOOK